Everything You Need To Know About Modular Home Mortgages

A comprehensive yet easy-to-understand explanation of mortgages on modular and prefabricated homes. What you don’t know can hurt you!

A comprehensive yet easy-to-understand explanation of mortgages on modular and prefabricated homes. What you don’t know can hurt you!

This article is part of our Definitive Guide to Building Modular.

There a few different types of loans that you can consider when financing a house, but in almost all cases, your best bet is to take a mortgage out on your home. A mortgage is simply a loan that’s taken out using your home or property as collateral. It can function in exactly the same way as any other loan, but since a home is typically the most valuable asset a person has, banks are more comfortable making loans for larger amounts of money. The most common loan made to finance a modular project is a 30-year fixed rate construction-to-permanent loan.

To learn how to get a mortgage now, read our article on Modular Home Mortgages In 4 Simple Steps.

Types of mortgages

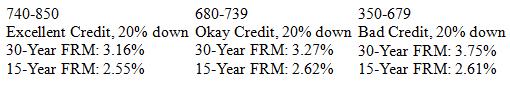

Fixed Rate Mortgage (FRM) – With a fixed rate mortgage, the rate you get when you first take out the mortgage is the interest rate you’ll have until it is paid in full. Unless you are certain that rates will go down and stay down until your loan is repaid, this is the best option since you won’t have any unpleasant surprises if rates skyrocket. If interest rates end up falling, sometimes you bank will allow you to refinance the loan, reducing the interest rate even further.

Adjustable Rate Mortgage (ARM) – If you have an adjustable rate mortgage, you will typically start with a fixed rate for a set amount of time after which your interest rate will be determined either annually, quarterly, or monthly. Since rates can go up at any time, this type of mortgage is more risky for the borrower. Typically the starting interest rate for will be .5% to .2% lower than a similar fixed rate mortgage, but since rates will almost certainly go up, it usually ends up being more expensive in the long run. Some banks prefer to use adjustable rate mortgages with large mortgages since the borrower is assuming some of the risk if the market changes.

Length of Mortgages

Mortgages are typically set to last for 15 or 30 years. The disadvantage of a shorter term loan is that you will pay more on a month-to-month basis. The advantage is that your APR will be lower and you’ll therefore pay less over the full life of the loan. If you can afford the higher monthly payment, it’s almost always a better option to pick a 15-year mortgage over a 30-year one.

Using the standard rates that someone with excellent credit might receive, we’ll compare the cost of a 30-year with a 15-year mortgage. A $200,000 30-year mortgage with a 20% down payment will result in a monthly mortgage payment of $938. With a 15-year mortgage, the monthly payment goes up to $1,320 per month, a difference of $382. The total amount paid over the life of the 30-year loan (including the down payment) is $287,839. The total amount paid over the life of the 15-year loan (including the down payment) is $232,705. We can clearly see that the 30-year loan will end up costing us $55,125 more over the life of the loan.

Standard Mortgage Rates